CHAPTER I: DEPARTMENT OF REVENUE

PART 130 RETAILERS' OCCUPATION TAX

SECTION 130.ILLUSTRATION A EXAMPLES OF TAX EXEMPTION CARDS

Section 130.ILLUSTRATION A Examples of Tax Exemption Cards

a) This Illustration A provides samples of the tax exemption cards issued by the U.S. Department of State to certain foreign government personnel and offices under the authority of the Foreign Missions Act (22 USC 4301 et seq.) prior to June 2011. The plastic cards, which are the size of credit cards and have a hologram, are valid nationwide. Cards are used at the point of sale for exemption from State and local sales taxes and similar taxes normally charged to customers. Some cards have restrictions on tax-free purchases. Tax exemption cards are not valid for exemption from taxes on telephones, other utilities, or gasoline purchases. Cards are not transferable. Only the person whose photograph appears on the front side of the card may use it. Vendors may ask for additional identification such as a driver's license.

b) Examples of tax exemption cards for personal purchases.

|

(Picture of Diplomat) |

UNITED STATES |

|

|

|||

|

DEPARTMENT OF STATE |

|

|

||||

|

Personal Tax Exemption Card |

|

BLUE STRIPE |

||||

|

|

|

Full tax exemption |

||||

|

MISSION: (Name of mission inserted here) |

|

on all personal |

||||

|

|

|

purchases |

||||

|

EXPIRATION DATE: 00/00/00 |

|

|

||||

|

NO: 0000-0000-01 |

SEX: M |

DOB: 00/00/00 |

|

|||

|

LAST NAME OF DIPLOMAT, FIRST NAME OF DIPLOMAT |

|

|||||

|

(Blue stripe here) |

|

|

||||

|

EXEMPT FROM ALL SALES TAX |

|

|||||

|

(Picture of Diplomat) |

UNITED STATES |

|

|

||

|

DEPARTMENT OF STATE |

|

YELLOW STRIPE Full tax exemption on all personal purchases except restricted categories identified on the face of the card. |

|||

|

Personal Tax Exemption Card |

|

||||

|

|

|

||||

|

MISSION: (Name of mission inserted here) |

|

||||

|

|

|

||||

|

EXPIRATION DATE: 00/00/00 |

|

||||

|

NO: 0000-0000-01 |

SEX: M |

DOB: 00/00/00 |

|

||

|

LAST NAME OF DIPLOMAT, FIRST NAME OF DIPLOMAT |

|

||||

|

(Yellow stripe here) |

|

||||

|

EXEMPTION NOT VALID FOR: FOOD; CLOTHING; RESTAURANTS; SERVICE; HOTELS; GROCERIES |

|

||||

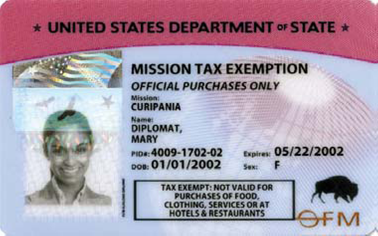

c) Mission tax exemption cards are issued to embassies, consulates, and international organizations for official purchases only and for the sole benefit of the mission identified on the face of the card. All purchases must be made in the name of the mission and paid for by mission check or credit card (not cash or personal check). Personal purchases are prohibited when using a mission tax exemption card.

d) Examples of tax exemption cards for mission (official) business.

|

(Picture of Diplomat) |

UNITED STATES |

|

|

||

|

DEPARTMENT OF STATE |

|

|

|||

|

Mission Tax Exemption Card |

|

BLUE STRIPE |

|||

|

|

|

Full tax exemption |

|||

|

MISSION: (Name of mission inserted here) |

|

on all official |

|||

|

|

|

purchases |

|||

|

EXPIRATION DATE: 00/00/00 |

|

||||

|

NO: 0000-0000-01 |

SEX: F |

DOB: 00/00/00 |

|

||

|

LAST NAME OF DIPLOMAT, FIRST NAME OF DIPLOMAT |

|

||||

|

(Blue stripe here) |

|

||||

|

EXEMPT FROM ALL SALE S TAX |

|

||||

|

(Picture of Diplomat) |

UNITED STATES |

|

YELLOW STRIPE Full tax exemption on all official purchases except restricted categories identified on the face of the card. |

||

|

DEPARTMENT OF STATE |

|

||||

|

Mission Tax Exemption Card |

|

||||

|

OFFICAL PURCHASES ONLY |

|

||||

|

MISSION: (Name of mission inserted here) |

|

||||

|

|

|

||||

|

EXPIRATION DATE: 00/00/00 |

|

||||

|

NO: 0000-0000-01 |

SEX: F |

DOB: 00/00/00 |

|

||

|

LAST NAME OF DIPLOMAT, FIRST NAME OF DIPLOMAT |

|

||||

|

(Yellow stripe here) |

|

||||

|

TAX EXEMPTION NOT VALID FOR: |

|

||||

|

SALES UNDER $350; HOTELS |

|

||||

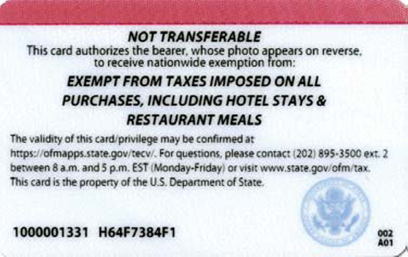

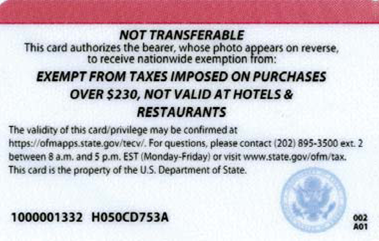

e) Examples of reverse of both mission and personal tax exemption cards.

|

NOT TRANSFERABLE |

||

|

This card entitles bearer, whose photo appears on reverse, to nationwide exemption from state and local sales taxes, restaurant and similar taxes normally charged to the customer. Vendor may ask for additional identification. |

||

|

IF FOUND PLEASE RETURN TO: |

||

|

|

Office of Foreign Missions |

|

|

|

U.S. Department of State |

|

|

|

3507 International Place, N.W. |

|

|

|

Washington, D.C. 20008-3034 |

|

|

|

202-895-3563 |

|

|

Monday through Friday |

Return Postage Guaranteed |

|

|

9:00 a.m.-4:00 p.m. EST |

Rev. 08-95 |

|

f) Beginning in June 2011, the U.S. Department of State began issuing new types of U.S. Department of State Diplomatic Tax Exemption Cards. The new Diplomatic Tax Exemption Cards are the same size as credit cards, made from plastic, and contain security features such as laser-engraved personalization of data, the inclusion of an optically variable device or kinegram, and tactile micro-text (small raised text). They are valid nationwide. These cards are used at the point of sale for exemption from State and local sales taxes and similar taxes normally charged to customers. Some cards have restrictions on tax-free purchases. Tax exemption cards are not valid for exemption from taxes on telecommunications, other utilities, or gasoline purchases. The cards are not transferable. Only the person whose photograph appears on the front side of the card may use the card. Vendors may ask for additional identification such as a driver's license.

1) New image and text of U.S. Department State Diplomatic Tax Exemption Cards. Each Diplomatic Tax Exemption Card bears an image of an animal (an owl, eagle, buffalo or deer, replacing the previously used blue/yellow stripes") indicating the cardholder's specific type of tax exemption and contains text outlining the scope of the exemptions. The types of exemptions given are determined on a case-by-case basis and, thus, will usually vary by cardholder. The images and text in this subsection (f)(1) were taken from the U.S. Department of State, Bureau of Diplomatic Security, Office of Foreign Missions' "New Tax Card Design Flyer" (publication dated June 2011), which can be found on-line at www.state.gov/ofm/tax/. Each card is unique to the cardholder, indicates whether the card was issued for official purchases only or for personal purchases, and lists the specific exemptions to which that cardholder is entitled.

A) OWL

Cards with this image are intended to be used solely in connection with official purchases; the cardholder/mission is eligible for exemption from sales, occupancy, restaurant/meal, and other similarly imposed taxes without restriction.

B) BUFFALO

Cards with this image are intended to be used solely in connection with official purchases; the cardholder/mission is subject to some degree of restriction on exemption from sales, occupancy, restaurant/meal, and other similarly imposed taxes. (For example, such cards may read "EXEMPT FROM TAXES IMPOSED ON PURCHASES OVER $300; NOT VALID AT HOTELS".)

C) EAGLE

Cards with this image are intended to be used solely in connection with personal purchases; the cardholder is eligible for exemption from sales, occupancy, restaurant/meal, and other similarly imposed taxes without restriction.

D) DEER

Cards with this image are intended to be used solely in connection with personal purchases; the cardholder is subject to some degree of restriction on exemption from sales, occupancy, restaurant/meal, and other similarly imposed taxes. (For example, such cards may read "EXEMPT FROM TAXES IMPOSED ON PURCHASES OF HOTEL STAYS, RESTAURANT MEALS, AND RENTAL CARS".)

2) Samples of the U.S. Department of State Diplomatic Tax Exemption Cards are for illustrative purposes only. It is important to look at the card to determine the precise exemptions to which the cardholder is entitled. The images below of the four types of U.S. Department State Diplomatic Tax Exemption Cards were taken from the "White Paper Detailing the Department of State's Newly Designed Diplomatic Tax Exemption Cards" found on the U.S. Department of State, Bureau of Diplomatic Security, Office of Foreign Missions website at www.state.gov/ofm/tax/.

A) Official Purchases Only, Without Restrictions

B) Official Purchases Only, With Restrictions

C) Personal Tax Exemption, Without Restrictions

D) Personal Tax Exemption, With Restrictions.

g) Taipei Economic and Cultural Representative Office (TECRO) Cards. Each TECRO card will indicate the cardholder's exemption type (e.g., Mission Tax Exemption Card or Personal Tax Exemption Card) and the exempted taxes (e.g., State and local sales taxes, restaurant and similar taxes). For illustrative purposes only, below are samples of the TECRO exemption cards. It is important to look at the exemption card to determine the precise exemptions to which the cardholder is entitled.

1) Personal Tax Exemption

2) Official Purchases Only

(Source: Amended at 39 Ill. Reg. 1793, effective January 12, 2015)